Joint Associations’ Letter: Call for an urgent expansion of the collateral requirements in energy markets

Executive summary

The objective of this letter is to present the views of EACH, EFET, Eurelectric and Eurogas1 on the proposals by the European Commission – the Delegated Regulation of 21/10/2022 amending the regulatory technical standards laid down in Delegated Regulation (EU) No 153/2013 as regards temporary emergency measures on collateral requirements2 – and the European Securities and Markets Authority (ESMA) – the Draft Technical Standards amending Commission Delegated Regulation (RTS) 153/2013 3 – (henceforth ‘the Authorities’) related to the emergency measures on collateral requirements and in particular their suggestions on bank guarantees and public guarantees.

We would like to highlight the following key points of this letter:

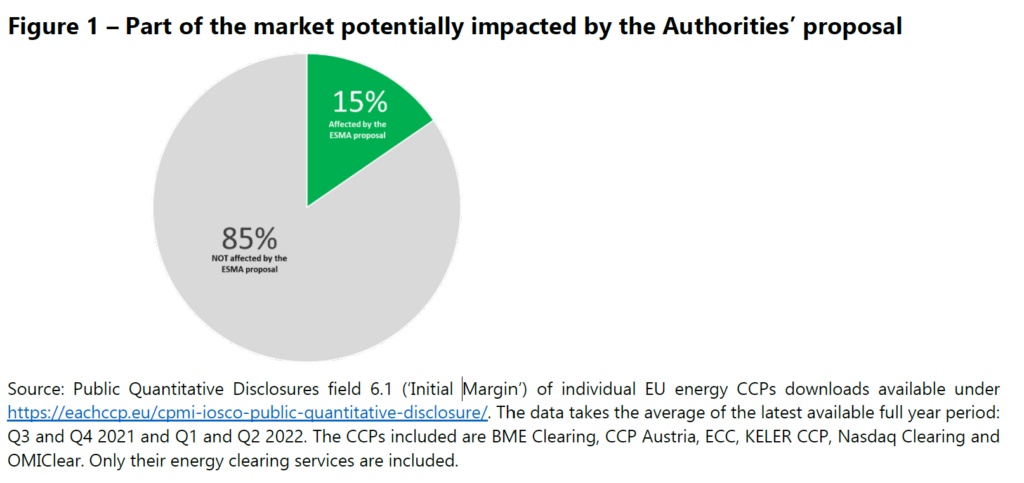

• Certain aspects of the Delegated Regulation adopted by the European Commission on temporary emergency measures on collateral requirements to alleviate the liquidity pressure on energy companies make it usable only by an estimated 15% of the energy market participants.

• Without a wider solution, and for a longer period of time, the liquidity pressure remains, leading to a decrease in the overall trading environment and prevents the market from gaining the full potential of bank guarantees by optimizing the procedural setup around this kind of collateral.

• We therefore kindly ask Authorities to reconsider certain aspects of the Delegated Regulation in order to efficiently address liquidity strains on non-financial counterparties.

Introduction

Bearing in mind the importance of all European economies to ensure the sound and safe operations of the energy markets under the current energy crisis, we recall the joint initiatives of EACH, EFET, Eurelectric, Eurogas and Europex when recommending the widening of collateral types acceptable by central counterparties (CCPs)4.

While we welcome the intention of the Authorities to alleviate the liquidity pressure of non-financial clients, and we recall the urgency of implementing amendments to the current regulations, we respectfully consider that the proposals put forward by the European Commission and ESMA to expand the collateral accepted by CCPs for either bank guarantees or public entity guarantees should be accessible for the wider energy clearing industry rather than just for non-financial energy counterparties that are clearing members. The following sections substantiate this assertion, analyse the ESMA and European Commission proposals and suggest some remedies going forward.

In summary, we suggest revising the Authorities’ proposals to:

- Bank guarantees – Ensure that the proposals on bank guarantees can benefit 100% of the energy clearing industry and not just an estimated 15% of it as they currently do;

- Public entity guarantees – Ensure a level-playing field regarding the welcomed extension of eligible collateral to publicly backed guarantees and the extensive list of possible issuers;

- Further step – In addition to the temporary solution currently proposed, we call on the Commission to extend the list of eligible collaterals to non-fully collateralized bank guarantees and EU Emission Allowances, and ideally through the “emergency procedure” of EMIR Art. 49(1e)5.

Regulatory goals

In the recitals of the Delegated Regulation, the European Commission clearly sets the framework for the collateral proposal and states:

(3) In order to ensure the smooth functioning of the Union financial and energy markets under the current circumstances and to alleviate the liquidity pressure on non-financial counterparties active on gas and electricity regulated markets cleared in CCPs established in the Union, the pool of eligible collateral available to non-financial clearing members should temporarily be expanded to include uncollateralised bank guarantees.

(7) In order to further limit the risks associated to the acceptance of uncollateralised bank guarantees for non-financial clearing members and public guarantees for financial and non-financial clearing members as collateral, those measures should be of temporary nature and granted for a period of 12 months, providing relief to market participants and incentivising them to return to the markets.

We therefore understand that the intention is to alleviate the liquidity pressure on non-financial counterparties (NFCs) active on regulated commodity markets that are cleared in the CCPs, and to provide relief to market participants as well as incentivise them to return to the markets. However, it should be stressed that:

• the liquidity pressure is felt alike by clearing members and non-clearing members i.e. client of clearing banks; and

• energy market participants, irrelevant of their status e.g. NFC or FC, are all subject to the same constraints related to cash liquidity. Unlike clearing banks which act as general clearing member and are large financial institutions, they do not have the same level of access to central bank money to source the required level of liquidity to face the margin cash calls from CCPs.

What emerges from the Delegated Regulation recitals above is a clear intention that all market participants may use these additional types of guarantees. This is why we want to reiterate that any proposed solution should address the core issue related to liquidity pressure and should not be limited to a smaller subset of market participants.

Bank guarantees

4.1. Scope

The Authorities suggest limiting the scope of commercial bank guarantees to energy non-financial counterparties that are acting as clearing members. This would leave out not only all energy counterparties that are non-clearing members and that access CCPs through a financial clearing member but also financial counterparty energy market participants that are not financial institutions and therefore do not have the same liquidity sourcing capacity as traditional banks (clearing banks). Furthermore, and based on the public figures available, this will mean that ESMA’s proposal may affect only an estimated 15% of the European energy clearing industry6 as measured by volumes of initial margin7. It is important to note that this number cannot simply be increased as most CCP models do not allow NFCs as direct clearing members.

4.2. Comments on the background analysis

While we welcome the intention of the Authorities to help alleviate the liquidity pressure of non-financial clients, we would respectfully like Authorities to consider in their analysis that:

- While financial clearing members have indeed been able to cope with increased liquidity pressures during the recent crisis, they also rely on non-financial (end) clients to meet the margin calls that lead to those liquidity pressures.

- There has been limited evidence of financial clearing members also providing intraday funding of margin calls and collateral transformation and therefore easing the liquidity strains on their clients.

- Due to the recent market events, we have seen certain dynamics occurring in the markets: some companies have been moving to OTC, while others have been moving towards cleared exchange products. The overall trading is decreasing because of increasing costs. However, what we have observed is that such dynamics are not limited to the Nordic market only.

In addition to the above, even non-fully backed commercial bank guarantees can help diversifying risk because the issuer of the guarantees would be different from the clearing member through which the client would access the CCP. As indicated in both ESMA and EBA answers8 to the European Commission request to conduct assessments on the developments in the energy derivative markets, the clearing of commodities is currently concentrated on a small number of banks, i.e. an increase concentration of risk. Furthermore, the inability of a non-financial non-clearing member to post liquidity (e.g. through bank guarantees) could spell trouble for the clearing member used to access the CCP.

4.3. Legal interpretation

We believe that the possibility for non-fully backed bank guarantees to be used by a wider number of energy market participants that use a clearing member to access the CCP would be possible through:

- Interpretation of Level 1 text – We consider that Article 46 of the EMIR legislation9 does not explicitly prohibit the recourse to bank guarantees for non-financial counterparties that are not clearing members. The first sentence of Art. 46(1) shall, from our point of view, be read and understood as the general rule, while the second sentence (see quote below) develops the exception to that rule and addresses specifically the situation of non-financial counterparties that are clearing members or non-clearing members, being allowed to use and pass-through bank guarantees to the CCP.

Excerpt of EMIR Article 46 - For non-financial counterparties, a CCP may accept bank guarantees, taking such guarantees into account when calculating its exposure to a bank that is a clearing member. - Amendments to Level 2 text – In line with the Authorities’ suggestion in their proposal that in Article 62, second paragraph, the following sentence is added:

o ‘However, Section 2, paragraph 1, point (h), of Annex I shall not apply in respect of transactions on commodity derivatives, as referred to in Article 2(30)of Regulation (EU) No 600/2014 from [the date of entry into force of this amending Regulation to 12 month after the date of entry into force of this amending Regulation].’

Correction to the text of Annex I, Section 2, point 1, subparagraph a) which currently states ‘(a) it is issued to guarantee a non-financial clearing member’ to either:

o Disapply it;

o Amend it to ‘(a) it is issued to guarantee a non-financialclearing membercounterparty.

Public entity guarantees

We generally welcome the extension of eligible collateral to publicly backed guarantees and the extensive list of possible issuers. We nevertheless remain doubtful about the accessibility of energy market participants to the entities set out in in the Annex10 to the Commission Delegated Regulation, Section 2a point (a), as well as the possibility for those entities of public law to fulfil the conditions set out in points (d) and (e) of the same Annex. In order to bring relief to market participants as soon as possible and in order to preserve a level-playing field within the European Union and applying similar standards, we strongly believe that:

- There is a need for a European solution, either via the issuers mentioned in point (a) (iii) or via European Investment Bank being a bank listed in point (a)(iv) of the Annex 2a to the Commission Delegated Regulation;

- This needs to be accompanied by respective common funding by all Member States;

- In order to maintain a level-playing field, we would advise to set out uniform conditions for companies to apply for those guarantees.

Conclusion

The Authorities suggest a 12-month time limitation for the suggested measures. From these Associations’ perspective, having a permanent solution rather than limiting in time the use of bank guarantees would be preferable. Extending this solution to a permanent basis would allow us to gain the full potential of bank guarantees by optimizing the procedural setup around this eligible collateral. We therefore kindly ask Authorities to reconsider certain aspects of the Delegated Regulation, i.e. in particular the scope and the time limitation, in order to efficiently address liquidity strains on non-financial counterparties.

In addition to the temporary solution currently proposed, we call on the Commission to extend the list of eligible collaterals to non-fully collateralized bank guarantees and EU Emission Allowances, and ideally through the “emergency procedure” of EMIR Art. 49(1e). Doing this as part of a more fundamental review of the EMIR Level 1 rules would – given the usual duration of Level 1 legislation proceedings – most likely not become effective before the beginning of 2025, which would be far too late in the light of the urgency to mitigate the energy crisis and to realise the energy transition by 2030.

1 EACH (European Association of CCP Clearing Houses), EFET (European Federation of Energy Traders), Eurelectric (Federation of the European Electricity Industry), and Eurogas (Association of companies in the gas value chain).

3 Draft Technical Standards amending Commission Delegated Regulation (RTS) 153/2013.

6 It is important to point out that the 15% is an overestimate, as CCPs having a direct clearing model do not have a model of 100% of direct (non-financial) clearers.

7 https://eachccp.eu/cpmi-iosco-public-quantitative-disclosure/

10 Annex to the Commission Delegated Regulation.